Income from Letting of Real Property. This PR which supersedes PR No.

According to the Public Ruling rental income can be treated as business sources.

. The IRS ruled that rent based on a fixed percentage of a prime tenants gross income from subtenants as reduced by escalation receipts received from the subtenants i. Section 4 a Business Income. If you own an investment property and collect rent from your tenants its important to d.

At issue was whether under the Fair Housing Acts accessibility requirements for newly. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. 20 Relevant provisions of.

The Ability Center of Greater Toledo v. Casting work to the side putting real life on pause and making your way to an exciting destination is a guaranteed way to help you relax and see new. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

If you rent out property youll have to pay rental income tax. Net rental income is the income you receive from your rental property after expenses associated with the home are deducted. 12004 issued on 30 June 2004 provides clarification on.

12 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Dividends are the forgotten heroes that have made countless investors rich. The letting of the house is a non-business source and the rental income is taxable under paragraph 4 d of the ITA.

Consider renting out your personal residence while you are away and pocketing the rental income tax-freeAn interesting tax break in the Internal Revenue Code provides that if a person rents out his or her personal residence for up to 14 days the rental income is tax free and does not need to be reported on the his or her tax return. A Ruling may be withdrawn either wholly or in. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is.

Its a good idea to know what this includes and what expenses you can deduct before. Based on Public Ruling PR 122018 the rental income is considered to be a business income if you provide support or maintenance services comprehensively and actively to your property. The IRS ruled that reimbursement of attorneys fees costs of litigation punitive damages and recovery of previously deducted expenses constitute gross income.

Course Title ACCOUNTING 1A. The IRB has published Public Ruling PR No. Taxation of Income Arising from Settlements dated 13 August 2021.

12 the situations or circumstances where rent or income from the letting of property can be treated as business income of a person under section 4a of the Act. RENTAL INCOME Public Ruling No. Monthly rental income 5000 5000 Annual rental income 60000 60000 Rental reduction of 50 for April May and June 2020 RM5000 x 50 x 3 months 7500 7500 Annual gross rental income 52500 52500 Special deduction1 RM2500 x 3 months - 7500 Taxable income 52500 45000 Tax payable 224 12600 10800.

Rental income from real property received by exempt organizations is normally excluded from unrelated business taxable income UBTI. 122018 Definition of Rental Incomeexpenses. According to the public ruling rental income can be.

Ohio On August 10 2020 the court issued an order granting partial summary judgment in favor of the plaintiffs and against the defendants in Ability Center et al. 36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in connection with the use or occupation of the. Moline Builders et al.

37B 41 and 77 of the Income Tax Act ITA. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. Net rental income is the amount of money leftover after all qualifying expenses are deducted from the rent collected.

122018 - INCOME FROM LETTING OF REAL PROPERTY The Inland Revenue Board of Malaysia LHDNM issued Public Ruling PR No122018 Third Edition on 19 December 2018 reported in our e-CTIM TECH-DT 972018 dated 21 December 2018. Based on Public Ruling PR 122018 the rental income is considered to be a business income if you provide support or maintenance services comprehensively and actively to your property. This PR which supersedes PR No.

32 credited in relation to an amount means more than a mere journal entry or an accrual. 30 INTERPRETATION The words used in this Ruling have the following meanings. However rent may not fall under the exclusion in various circumstances such as when substantial personal services are provided to lessees if more than 50 of the rent is for the use of personal property if the property is debt.

For a year is RM500 while quit rent is RM50 a year. Ii letting of real property as a non-business source under. 36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in connection with the use or occupation.

The Inland Revenue Board IRB has issued Public Ruling No. The new 18-page PR comprises the following paragraphs and sets out 20 examples. 31 company means a company incorporated or registered under companies Act Chapter 39 or any law in force elsewhere.

Item Without special deduction RM With special deduction RM Monthly rental income 5000 5000 Annual rental income 60000 60000 Rental reduction of 50 for April May and June 2020 RM5000 x 50 x 3 months 7500 7500. Pages 16 This preview shows page 8 - 10 out of 16 pages. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

It must be provided by the owner himself or through hiring of a manager. 11 the treatment of rent as a non-business source of income under section 4d of the Income Tax Act 1967 the Act. If you own an investment property and collect rent from your tenants its.

Whether you rent a singl. Section 4 d Rental Income. I letting of real property as a business source under paragraph 4 a of the Income Tax Act 1967 ITA.

It replaces PR 42011 dated 10 March 2011 please refer to our e-CTIM No132011 dated 1 April 2011. View Topic 5c- Rental and Royalty incomepptx from TAX ACT3151 at Universiti Putra Malaysia.

Toyota Slumps On Pessimistic Outlook Unprecedented Costs Bnn Bloomberg

Court Case Indicates Capital Gains Tax Is Due On Suites House Hunt Victoria

Tax Exemptions What Part Of Your Income Is Taxable

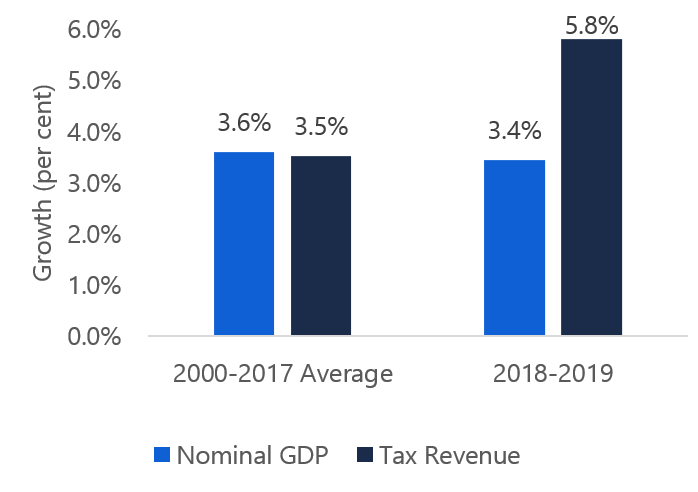

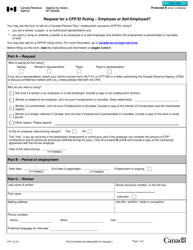

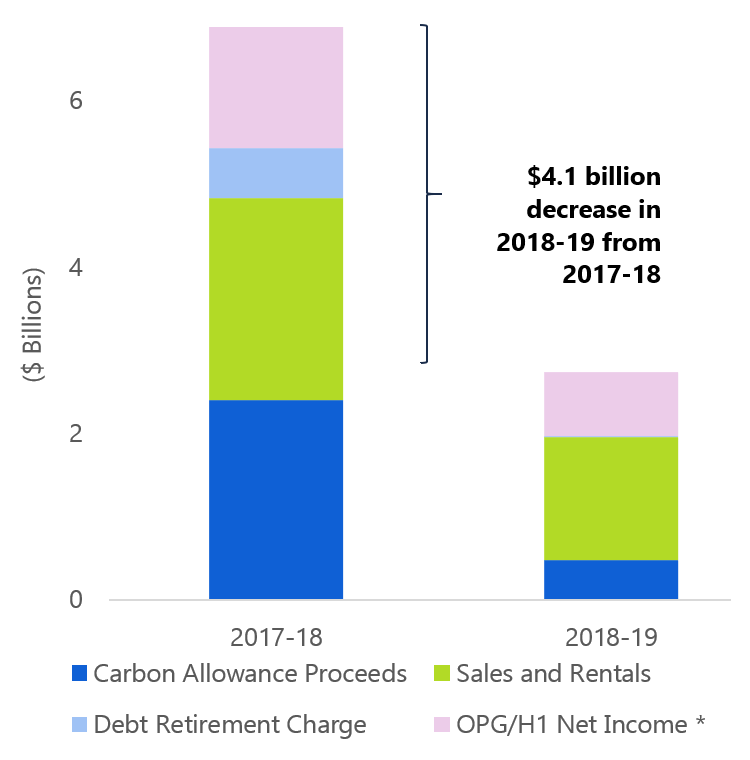

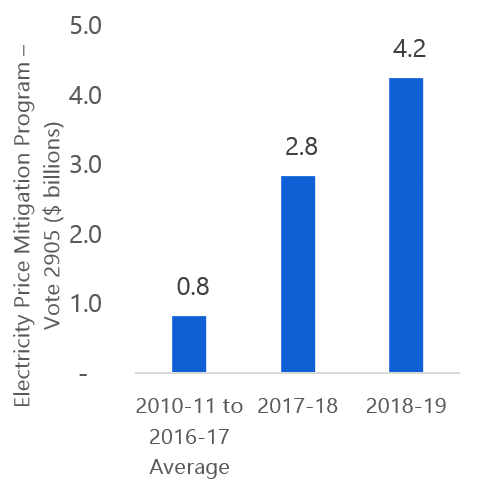

Understanding Ontario S 2018 19 Deficit

Form Cpt1 Download Fillable Pdf Or Fill Online Request For A Cpp Ei Ruling Employee Or Self Employed Canada Templateroller

Real Estate Agents And Income Taxes 2022 Turbotax Canada Tips

Form Cpt1 Download Fillable Pdf Or Fill Online Request For A Cpp Ei Ruling Employee Or Self Employed Canada Templateroller

Understanding Ontario S 2018 19 Deficit

Understanding Ontario S 2018 19 Deficit

Understanding Ontario S 2018 19 Deficit

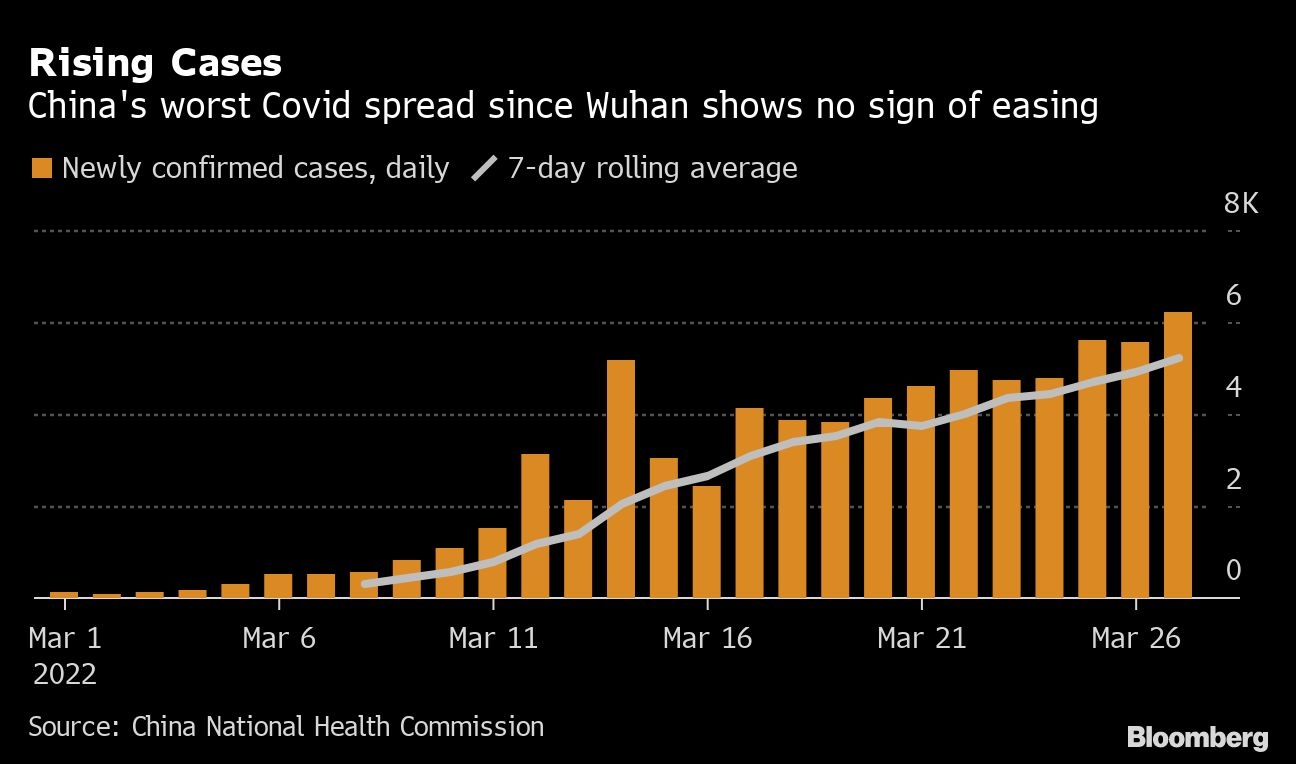

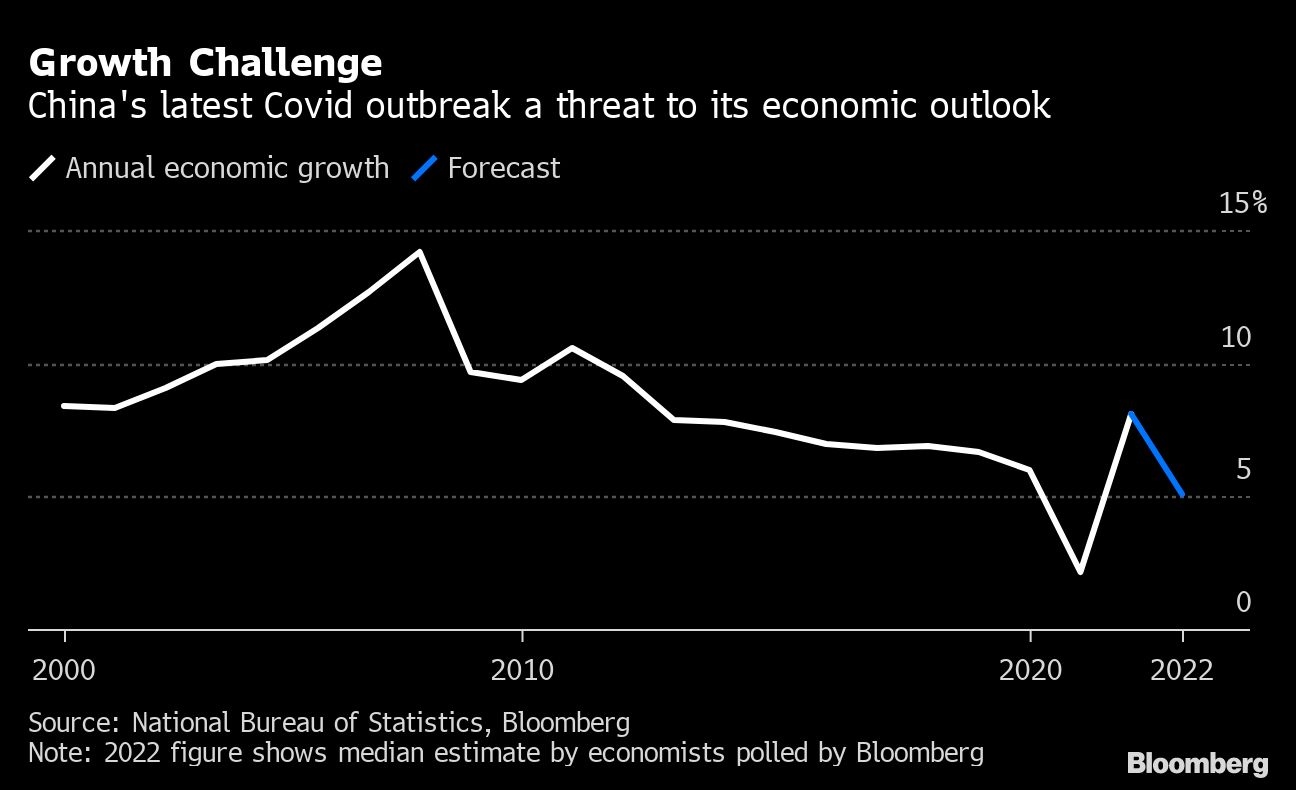

China S Economy Faces New Blow From Shanghai Covid Lockdown Bnn Bloomberg

What Happens At An Eviction Hearing Steps To Justice

China S Economy Faces New Blow From Shanghai Covid Lockdown Bnn Bloomberg